Supporting the future of digital finance

The financial sector is, much like the rest of the world, increasingly digitised. This increased reliance on online mediums leaves us vulnerable to entirely new threats that were historically of little concern to the financial industry. This is precisely why the Secure Swiss Finance Network (SSFN) plays a critical role in the future of digital banking.

What is the SSFN?

The Swiss financial sector has used dedicated services such as Finance IPNet to modernise critical services, like the payment system which manages online transactions in Switzerland. These communication services help secure transactions, financial users, and banks when conducting online banking activities.

The Secure Swiss Finance Network (SSFN) is the next evolution for the services Finance IPNet provides. SIX (Swiss Exchange), SNB (Swiss National Bank), and SWITCH, along with Anapaya, teamed up to establish a better, more secure, and more reliable way to access payment, transaction, and financial information services with the SSFN.

The SSFN is a more reliable, controllable, and resilient alternative to Finance IPNet. It will enable a more secure and stable experience for the Swiss financial sector as it increasingly depends on digital transactions.

The aim and scope of the SSFN are to:

- Provide a consistent and secure way to conduct digital financial activities.

- Enable flexible communication between SSFN participants with any-to-any architecture instead of point-to-point connections, enabling users to connect to each other more easily and with flexibility.

- Protect the Swiss financial sector against the rising threat of cyber attacks.

Financial industry specialists have been notified by SIX to begin the migration process early in collaboration with their network infrastructure professionals. There will be no impact on the end-users of business applications since all adjustments will be made at the network level.

How does the SSFN work?

The SSFN is a SCiON-based Isolation Domain (ISD), used exclusively for the Swiss financial sector. This means that it will allow for trusted and secure communication between Swiss financial institutions and their infrastructure because all members of the network are certified partners.

The SSFN presents an innovative breakthrough for Swiss financial institutions and their IT infrastructure. It offers a decentralised any-to-any architecture, extreme reliability, protection against network-level threats, and clearly defined governance and trust anchors.

SCiON, a networking protocol that solves several long-known problems of the legacy internet. It aims to replace the current Internet core protocols on a global level and represents a fundamental shift from today’s routing-table-based Internet. With SCiON, senders of data may select which routing paths and countries their data travels through. This eliminates many security concerns, such as DDoS attacks and BGP Hijacking, while giving control and flexibility back to the sender of the traffic. In terms of the financial services industry, this means that communications will be more secure and efficient than ever before.

Financial institutions such as banks can apply to join the SSFN and SCiON in a similar fashion to traditional connectivity service providers for more secure and stable communications.

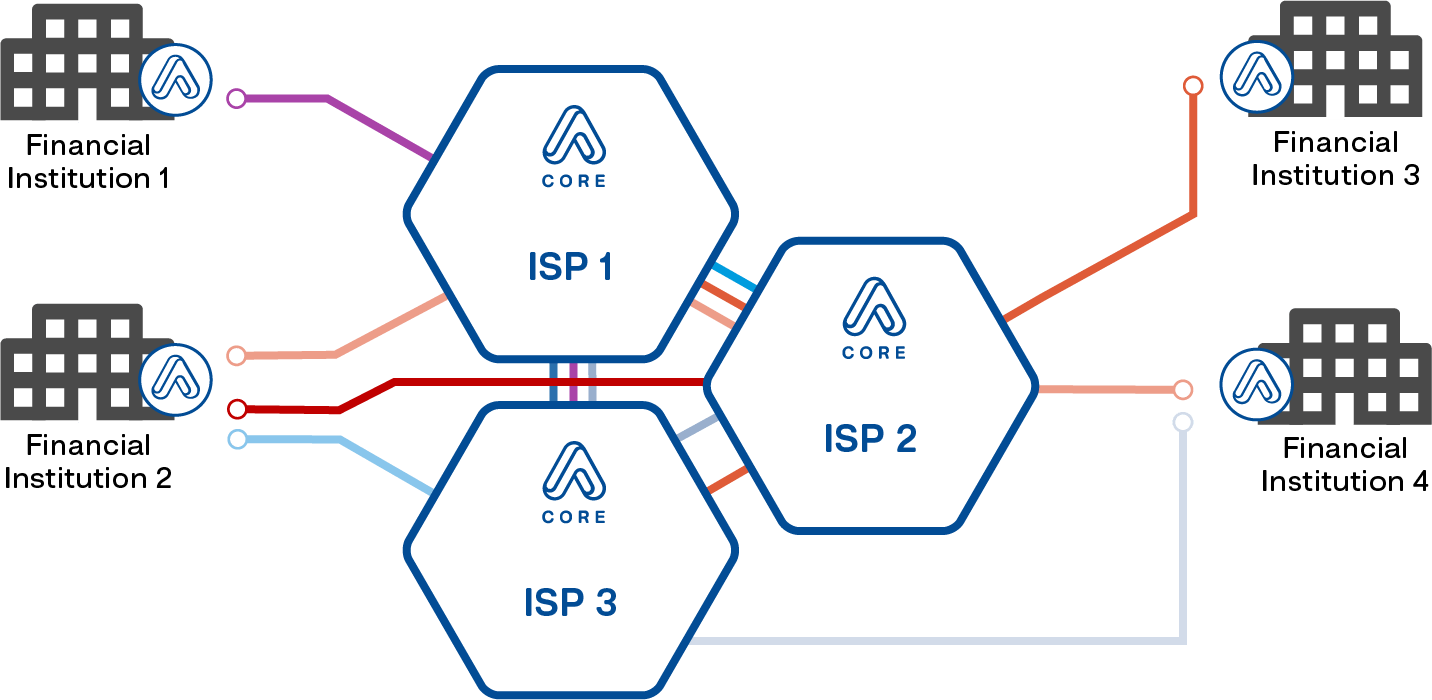

As can be seen in the graph above, with SSFN, financial institutions are able to securely communicate data through multiple ISPs.

Why the SSFN is critical today

Society at large is increasingly reliant upon digital methods to accomplish daily tasks. Making reservations, working remotely and conducting meetings all take place online. Online banking and other financial tasks are no exception to this rule, with the key difference being that they carry a much larger risk to the victims of cybercrime.

80% of firms saw an increase in cyber attacks since 2020, with a 238% rise in cyber attacks on banks. Cybercriminals are clearly taking advantage of the new way of life for the majority of people and businesses, however, technological developments like SCiON are actively combating these criminal efforts.

SCiON technology employed by SSFN offers financial institutions the ability to select which networks their data passes through and puts the control back in the hands of the data owner, or financial institutions. Additionally, the SCiON network is completely immune to routing attacks, with information only being sent only through legitimate networks registered through the SCiON-fabric. This allows businesses with sensitive data, such as banks, peace of mind whenever they connect.

One such SCiON network is the SSFN, which will completely exclude non-financial participants. The path of data can immediately be changed when faced with any operational disruption, keeping downtime to a minimum. It also offers financial institutions the ability to quickly remedy DDoS attacks and data breaches while retaining complete immunity to BGP hijacking. This makes the SSFN one of the safest and most reliable ways to conduct online banking and financial activities.

Technologies like SCiON and the SSFN are a path forward for a society that relies upon online solutions and infrastructure to function. While Gartner predicts that anti-cybercrime security spending will reach $133.7 billion by the end of 2021 this is a rolling expense. As cybercriminals will always find new and better ways to get around security measures, the only way forward is to gain total control of your own data. In this way, the SSFN, and SCiON are critical as we develop more and better ways to utilise the internet safely and efficiently.

Connect to the future

The SSFN is one of many examples of how Anapaya is changing the current connectivity landscape. Whether offering a superior way to connect, a more secure network or putting the control of data back in the hands of those who own it, Anapaya’s solutions are set to challenge what we expect from networking by addressing many of the challenges faced by the legacy internet.

If you want to stay up to date with the latest developments of Anapaya’s revolutionary innovations, be sure to stay tuned to our blog or contact us for more information. Alternatively, if you are a bank instructed to join the SSFN, book a meeting here.